Introduction

An individual doing paid work in the UK falls into one of three main categories:

- an employee

- a worker

- self-employed

Your PA’s employment status, i.e. whether they are employed or self-employed, is not a matter of choice. Whether a PA is employed or self-employed depends upon the terms and conditions of their engagement with you.

HM Revenue and Customs (HMRC) regard most PA work as employment and therefore very few PAs are genuinely self-employed.

Employment status is significant because employers will be liable for the majority of employment rights if those working for them are found to be employees rather than self-employed.

There are essential tax and National Insurance contribution differences depending on employment status. You must recognise which category the people who work for you belong to, to ensure you fulfil your legal and tax obligations to them.

Employed or self-employed?

It is very important that you know the correct answer to this question (your PA’s ‘employment status’) because it affects the way that your PAs pay their tax and National Insurance. Your PA’s employment status refers to whether they are employed by you or self-employed (working for themselves). If you take a new PA on, you are responsible for determining their employment status. This applies to all new PAs, whether they’re full-time, part-time, permanent, temporary or casual.

If your PA is an employee or worker then you, as the employer, are responsible for tax and National Insurance contributions (NICs) on their behalf. They are also entitled to paid holiday and may be eligible for a pension. If they are an employee or worker, your payroll service can calculate the relevant tax and National Insurance deductions that need to be made each time they are paid. If your PA is self-employed they are responsible for calculating and paying their own tax and NICs on any payments you make to them.

What’s the difference?

Employment status isn’t a matter of choice for either you or your PA. It’s a matter of fact, based on key terms and conditions of your working relationship with them. In most cases these terms and conditions will be reflected in your contract with the worker. But even if a contract says a PA is self-employed, if the facts indicate otherwise then the PA may be your employee. If you don’t get it right, you could end up having to pay extra tax, National Insurance, interest and possible penalties later as well as being liable for any holiday and pension contributions which they would have been entitled to as an employee/worker.

In order to answer this question it is necessary to determine whether your PA works for you:

Under an employment or worker contract issued to the PA by you in which case they are an employee/worker.

Or

Under a contract for services that the PA gives to you in which case they are self-employed,

There is no statutory definition of these two types of contract. What you and your PA call your relationship, or what you consider it to be, is not decisive. It is the reality of the working relationship that matters. This is what HMRC will look at if you ask them to decide the employment status of your PA.

Who makes the decision on whether my PA is employed or self-employed

It is very important to understand that it is your responsibility to correctly decide the ‘status’ of your PA (whether they are employed or self-employed) based on the specific working arrangements between you.

You cannot just pick a status because it is better for you or because the PA wants to be self-employed or states they are classed as self-employed for other work they do. If the status is wrong, an employment tribunal and tax law can override this. This means that even if you have a contract with your PA that says they are self-employed, if the facts indicate otherwise, HMRC can decide that they must be treated as your employee.

You need to decide the status of any PA that works for you, including ones that you are matched with via an ‘introductory’ agency (even if the agency calls them ‘self-employed’). The only time you do not need to worry about deciding the status of your PA is where they supply their services through their own limited company or through an agency that they are both paid and ‘managed’ by – in these cases, the responsibility for deciding their status lies elsewhere.

How do I decide if my PA is employed or self-employed?

In most cases it is generally straightforward as to whether your PA is an employee or self-employed. The general rule is that your PA will be:

- an employee if they work for you and do not have the risks of running a business

- self-employed if they run their own business on their own account and are responsible for the success or failure of that business

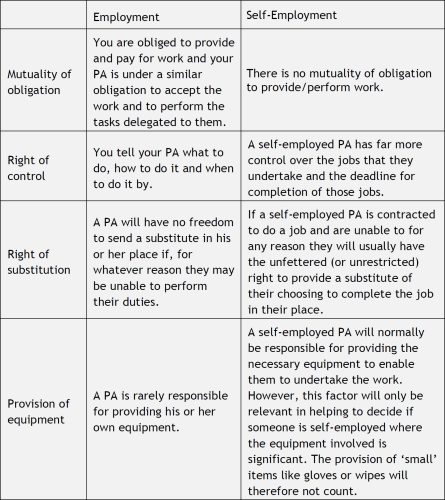

In deciding whether a PA is working for you or in business on his or her own account, a variety of factors are relevant. Some of the most important ones in a care and support situation are outlined below:

The answers to the questions above will help you to form a general picture of your PA’s employment status. However, simply answering them is not enough on its own to act as a formal decision about your PA’s employment status, you will also need to complete the HMRC Check Employment Status For Tax tool online (further details on how to access the tool are given below

Please contact Independent Lives so that they can assist you with assessing the status of your PA to see whether self-employment or employment is indicated.

HMRC provides further detailed information about self-employment on its website. To view this, visit: https://www.gov.uk/working-for-yourself.

Requesting a decision from HMRC

If your PA is self-employed you need to get formal confirmation of this from HMRC in order to ensure that you are protected from financial penalties. There are two ways of doing this.

Check employment status for tax

HMRC’s ‘Check employment status for tax’ tool enables you to check the employment status of your PA to determine whether they are employed or self-employed for tax, National Insurance contributions (NICs) or VAT purposes.

To access this tool visit https://www.gov.uk/guidance/check-employment-status-for-tax.

The ‘check employment status for tax’ tool will ask a series of questions about the PA’s work and will then provide an indication of their employment status. You can rely on the outcome as evidence of a PA’s status for tax/NICs/VAT purposes if you have met the following conditions:

- your answers to the questions on the ‘check employment status for tax’ tool accurately reflect the terms and conditions under which the PA provides their services. Read the guidance notes on each page.

- the tool has been completed by you the employer or your authorised representative (if a PA completes the tool the result is only indicative).

However, you should print or save a copy of the ‘Keep a copy of your determination’ results page, which comes up when you have completed the ‘Do you want to add some details to this document?’ page.

PAs who are directly employed by an individual, or related third party and self-employed PAs with an agreement to work directly for an individual and under their control without the involvement of an agency or employment business involved in managing or directing the care provided, do not need to be CQC registered for that regulated activity. This is because the current regulated activity of personal care sets out an exemption relating to PAs (self employed and employed).

For more information on what you need to check, please see employers’ template 7.2(b) Self-employment advice and guidance template.

A letter detailing the relevant information required from the PA should also be sent. Once completed, it should be signed by both parties and kept as a written record. Please contact Independent Lives for a template.

Please note self-employed PAs should fund their own public liability insurance (which should ensure their business for the provision of care and personal support) and training and should show you the relevant paperwork, on request, before they start working with you.

Employment Status Customer Service Unit

You can also call HMRC to discuss your PA’s employment status. If you do this, you must note the time of the call and the person you spoke to, in case of doubt later down the line. Phone: 0300 123 2326.

You can also write to HMRC to check if your PA’s employment status.

Write to:

HMRC –

HM Revenue and Customs

Employment Status Customer Service Unit

S0733

Newcastle Upon Tyne

NE98 1ZZ

Frequently asked questions

Does my service provider/self-employed carer need to register with the Care Quality Commission – CQC?

Care Quality Commission – CQC – is the independent regulator of health and social care in England, who monitors, inspects and regulates health and social care services. People and organisations who are planning to run a health or adult social care service will need to apply to register with them as a service provider before they can carry out any of the activities the CQC regulates.

A service provider can be an individual, a partnership or an organisation. It is CQC that decide who needs to register with them and who might be exempt under certain conditions. Where a person, or a related third party on their behalf, makes their own arrangement for nursing care or personal care, and the nurse or carer works directly for them and under their control without an agency or employer involved in managing or directing the care provided, the nurse or carer does not need to register for that regulated activity.

What are regulated activities?

By law service providers, such as agencies must register for each of the regulated activities that are carried out. Regulated activities are listed in Schedule 1 of the Health and Social Care Act 2008 (Regulated Activities) Regulations 2014. Here are the most relevant examples when focusing on using service providers linked to Direct Payments and Personal Health Budgets:

- personal care

- accommodation for a person who requires nursing or personal care

- treatment of disease, disorder or injury

- transport services, triage and medical advice provided remotely

- nursing care

What is personal care?

The definition of personal care is broader than that used in previous registration systems. It covers:

a) physical assistance given to a person in connection with:

- eating or drinking (including the administration of parenteral nutrition);

- toileting (including in relation to menstruation);

- washing or bathing;

- dressing;

- oral care,

- the care of skin, hair and nails (with the exception of nail care provided by a chiropodist or podiatrist),

b) the prompting and supervision of a person to do any of the types of personal care listed above, where that person is unable to make a decision for themselves in relation to performing such an activity without such prompting and supervision. For examples some clients with Learning disabilities or clients with Dementia might fall into these categories.

As an advice service we highly recommend that if the PA is unsure whether they need to be registered with CQC, that they check this with CQC.

Further details can be found on www.cqc.org.uk or contact CQC via their National Customer Service Centre on 03000 616161 or email enquiries@cqc.org.uk.

The person I would like to use for providing support to me is a self-employed childminder/cleaner/nanny/hairdresser/accountant. Does this mean this person is automatically self-employed to provide general support and/or care for me?

Your PA’s employment status, i.e. whether they are employed or self-employed, is not a matter of choice and it is not relevant if the person is self-employed in a different occupation/different working relationship with other people. Whether a PA is employed or self-employed depends upon the terms and conditions of their engagement with you.

HMRC regard most care work/personal assistant work as employment and therefore very few PAs are genuinely self-employed. Please contact our advice service and discuss the conditions and circumstances of your working relationship with the potentially self-employed PA.

The person I would like to use for providing support to me says she/he is registered as self-employed with HMRC. Does this mean this person is automatically self-employed to provide general support and/or care for me?

Your PA’s employment status, i.e whether they are employed or self-employed, is not just a matter of choice or simply registering with HMRC as self-employed. Whether a PA is employed or self-employed depends upon the terms and conditions of their engagement with you.

Please use the HMRC ‘Check employment status for tax’ tool. HMRC regard most care work/personal assistant work as employment and therefore very few PAs are genuinely self-employed. Please contact our advice service and discuss the conditions and circumstances of your working relationship with the potentially self-employed PA.

Micro providers

Micro providers are care and support services working in the community they serve. They can be individuals, groups, voluntary or community organisations or small businesses. A micro provider has no more than five paid or unpaid full-time equivalent workers.

Due to their size, micro providers can offer a broad range of diverse, personalised and flexible support – from home care services, to support with exercise, social activities or employment.

If you would like more information or advice on micro providers please contact us or speak to your adviser.