This factsheet provides you with essential information about how you should manage new and expectant mothers in your workplace.

Introduction

If your PA tells you that she is pregnant there are lots of things that you will need to think about.

Your PA has five key rights if she is expecting a baby. They are:

- reasonable paid time off for antenatal care

- statutory maternity leave

- statutory maternity pay or maternity allowance

- protection against unfair treatment or dismissal

- adequate protection of her health and safety

This factsheet will guide you through this process and help you to plan for your PA’s maternity leave.

Key terms

| New or expectant mother | Someone who is pregnant or who has recently given birth (within the past six months). | |

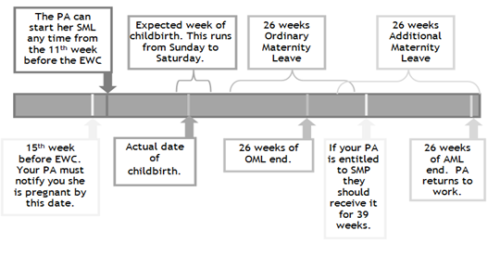

| Statutory Maternity Leave | SML | All employees have the right to 26 weeks of Ordinary Maternity Leave and 26 weeks of Additional Maternity Leave making one year in total. The combined 52 weeks is known as Statutory Maternity Leave. |

| Ordinary Maternity Leave | OML | The first 26 weeks of SML. |

| Additional Maternity Leave | AML | The 26 weeks of SML following on from OML. |

|

Compulsory maternity leave |

Your PA must take a minimum of two weeks maternity leave after the birth of her child to allow her to adequately recover. | |

| Expected Week of Childbirth | EWC | The expected week of childbirth is the week, beginning Sunday, in which it is expected the PA will have their baby. This is the date indicated on the MAT B1 form. |

| Statutory Maternity Pay | SMP | This is a weekly payment made to your PA whilst they are on maternity leave. You can claim this back later. |

| Maternity Allowance | Your PA will get Maternity Allowance if she is not eligible for Statutory Maternity Pay. You should return her MAT B1 form to her so that she can claim this. |

Timeline

Key employer tasks

When your PA notifies you, she is pregnant, and you have discussed how much maternity leave she wishes to take you should write to her to let her know when she will be returning to work. If you wish you can use employer template 5.3(a) Template letter confirming PAs maternity leave for this purpose.

When your PA notifies you, she is pregnant you must also complete a specific risk assessment for her. If you wish you can use employer template 4.2(b) Risk assessment for new and expectant mothers for this purpose.

For more information please see section 4.2 of this factsheet.

Statutory maternity leave

Maternity leave is intended to allow the mother to recover from giving birth and to bond with and care for her new child.

If your PA is pregnant, they are entitled to 52 weeks statutory maternity leave (SML) around the birth of their child regardless of how long they have worked for you or how much they earn.

How long is statutory maternity leave?

The 52-week SML period is made up of 26 weeks’ ordinary maternity leave (OML) followed immediately by: 26 weeks’ additional maternity leave (AML).

Your PA does not have to take the full 52-week allowance if she doesn’t want to. However, she must take a minimum of two weeks’ leave after the birth of her child to enable her to recover (compulsory maternity leave). You must not allow her to work during this time under any circumstances.

Your PA’s employment contract continues throughout her SML unless either you or the PA expressly ends it, or it expires (e.g. a fixed term contract). SML does not break continuity of employment.

Notification and confirmation of maternity leave

To qualify for SML, your PA should notify you no later than the end of the 15th week before the expected week of childbirth (EWC) of:

- the fact that she is pregnant;

- the expected date of the baby’s birth; and

- the intended start date of her maternity leave.

Your PA can choose to begin her SML any time from 11 weeks before the EWC up until the birth itself.

If your PA doesn’t give you the required notification, she loses the right to start her SML on her chosen date. However, you must make an exception where it was not reasonably practicable for the employee to give you notice any earlier. For example, your PA may not be able to notify you properly if her baby is born much earlier than expected. In these circumstances, she still qualifies for 52 weeks’ SML.

Your PA should show you the MAT B1 form (‘maternity certificate’) that she will receive from her doctor or midwife to confirm that she is pregnant. The expected date of birth is given on the MAT B1 form. The EWC is the week in which the expected date of the baby’s birth falls.

If your PA plans to take SML, she only needs to provide a MAT B1 form so that you can work out whether she can qualify for Statutory Maternity Pay (SMP). This factsheet explains how to do this at section 3. If she does not qualify for SMP, you must return the MAT B1 form to her because she will need it to claim Maternity Allowance.

After receiving her notification, you must notify your PA of the date on which her maternity leave will end within 28 days of her notification. This will normally be 52 weeks from the intended start of her maternity leave. If you wish you can use employer template 5.3(a) Template letter confirming PAs maternity leave to help you with this task.

If you fail to give your PA proper notification of the date she is returning to work and she wishes to change her return date, she won’t have to give you the normal eight weeks’ notice of that change.

When your PA returns to work

- After Ordinary Maternity Leave (OML)

If your PA is returning during or at the end of the first 26 weeks (OML) she is entitled to return to the same job on terms and conditions (e.g. salary and hours) as if she hadn’t been away.

- After Additional Maternity Leave (AML)

If she takes more than 26 weeks SML i.e. she takes AML as well she is entitled to return to the same job on the same terms and conditions. However, if that isn’t reasonably practicable, she is entitled to return to a suitable job on terms and conditions at least as good as her previous job.

If you take on a temporary member of staff to cover your PA’s maternity leave and you expect their employment to end when your original PA returns you must tell the temporary PA this up front when they start work i.e. put them on a fixed term contract. It is fairer to the temporary PA and it also protects you if there is a dispute over the ending of the fixed term contract.

Additional information about maternity leave

- SML remains at 52 weeks regardless of the number of children resulting from a single pregnancy e.g. if they have twins or triplets.

- if your PA gives birth to a stillborn baby, she is still entitled to maternity leave if the birth happens after 24 weeks of pregnancy. If a stillbirth or miscarriage occurs before the end of the 24th week of pregnancy, you might wish to consider allowing your PA to take sick or compassionate leave instead.

- if your PA is off work with a pregnancy related illness you must pay her in the same way as for any other type of illness e.g. statutory sick pay. If you have disciplinary rules related to sick leave, then pregnancy-related illness must be excluded.

- your PA is entitled to choose when to start her maternity leave. However if she is absent from work for a pregnancy-related reason and the absence is less than 4 weeks before the EWC – but before her intended SML start date, you can start her maternity leave as soon as she is absent. In these circumstances, her SML will begin the day after the 1st day of her pregnancy-related absence.

- SML begins on the day after the day of childbirth if the birth occurs before her SML was due to start.

- after giving you her notification, your PA can change her intended SML start date as long as she notifies you of the new start date. She must do this by whichever is the earlier of:

- 28 days before the date she originally intended to start her leave

- 28 days before the new date she wants to start her leave

- during SML your PA continues to accrue annual leave. Your PA may not take annual leave during her SML. You should instead allow her to take any untaken annual leave before and/or after her SML. You cannot pay your PA in lieu of any untaken annual leave unless the employment contract is terminated. Your PA’s SML will begin automatically if she gives birth during a period of annual leave prior to her SML.

Statutory maternity pay (SMP)

Statutory maternity pay (SMP) is paid for up to 39 weeks and usually covers the first 39 weeks of your PA’s SML. However, unlike SML, your PA must meet certain qualifying conditions to receive SMP. As the employer, you pay the SMP, but you can reclaim all or most of it from the government.

Qualifying for SMP

To qualify for SMP your PA must have:

- worked for you continuously (full or part-time) for at least 26 weeks up to and into the 15th week before the week her baby is due.

- average weekly earnings at least equal to the Lower Earnings Limit (LEL) for National Insurance Contributions (NICs). This is currently £125 a week.

- given you the right paperwork confirming the pregnancy e.g. MAT B1 form and sufficient notice of when they would like the SMP payments to start.

What happens if my PA does not qualify for SMP?

If your PA doesn’t qualify for SMP you must give them form SMP1 ‘Why I cannot pay you SMP’. You can download a copy of SMP1 ‘Why I cannot pay you SMP’ at:

In these circumstances your PA might be able to claim Maternity Allowance instead. They can find out more about claiming Maternity Allowance from the Department for Work and Pensions (DWP).

How much do I have to pay my PA if they are entitled to SMP?

If you use a payroll service, they will be able to calculate the relevant rates of SMP payable to your PA and help you to claim these payments back.

If your PA is eligible for SMP they are entitled to receive SMP for 39 weeks. Usually you pay it during the first 39 weeks of maternity leave.

For the first 6 weeks you must pay SMP at the rate of 90% of your PA’s average weekly earnings.

For the next 33 weeks you must pay them the lower of the following:

- £187.18

- 90% of their average weekly earnings

SMP is subject to Tax and National Insurance.

If you wish you can use, HMRC’s easy to use online SMP calculator to work out how much SMP you will have to pay and how much you can recover. The online calculator will work out for you:

- whether your PA is entitled to be paid SMP;

- the amount of SMP you should pay; and

- how much you can recover.

You can access the calculator at: http://www.hmrc.gov.uk/calcs/smp.htm.

Claiming back SMP

You are entitled to claim back at least 92% of SMP. Small employers can claim back all the SMP plus some compensation. If paying SMP will cause you cash flow problems, you can claim the money in advance in some circumstances.

If your annual liability for Class 1 National Insurance contributions is £45,000 or less, you are entitled to:

- claim 100% of the SMP back.

- an additional amount as compensation for the National Insurance contributions you pay on the SMP.

For more information on SMP please see the GOV.UK webpage on the topic. This is available at: https://www.gov.uk/employers-maternity-pay-leave

Additional information

Additional rights for new and expectant mothers

Expectant mothers also have other key rights at work:

Protection of her health and safety, and that of her baby

As such you must carry out a risk assessment taking her pregnancy and maternity specifically into account. The risk assessment identifies risks to your PA and her child while she is pregnant and after she has had her child, particularly if she is breastfeeding.

Paid time off for antenatal care

Your PA is entitled to reasonable time off work for antenatal care regardless of how long she has worked for you. Any time off must be paid at the PA’s normal rate of pay. It is unlawful for you to refuse to give your PA reasonable time off for antenatal care or to refuse to pay her at her normal rate of pay.

You can ask for evidence of antenatal appointments from the 2nd appointment onwards. Your PA should show you an appointment card or some other written evidence of her appointment.

Antenatal care may include relaxation or parent craft classes as well as medical examinations, if these are recommended by your PA’s doctor or midwife. If it is possible, your PA should try to avoid taking time off work when they could reasonably arrange classes or examinations outside working hours.

Not to be made to suffer any unfair treatment and not to be dismissed or selected for redundancy on grounds related to her maternity

It is an automatically unfair dismissal if you dismiss – or select for redundancy – your PA solely or mainly:

- a reason relating to her pregnancy.

- because she tried to assert her right to paid time off for antenatal care.

As pregnancy-related dismissals are discriminatory, it is likely that a pregnant employee would not only claim unfair dismissal but also unlawful sex discrimination. There is a limit on the amount of compensation a tribunal can award for unfair dismissal but not for unlawful discrimination.

Employees who tell their employer they are pregnant on or after 6 April 2024 will have a right to be offered a suitable alternative vacancy above other employees. This protection will start from the point the employee tells their employer they are pregnant and will continue until 18 months after either the expected week of childbirth, or the exact date of birth if the employee tells the employer this. In addition, employees whose maternity leave ends on or after 6 April 2024 will have the added protection in relation to the period after the birth.

Once her child is born your PA also has the following right:

To ask for a flexible working pattern to help her care for her child. This means that you must seriously consider it if they make a request to change their working pattern when they come back to work and allow it if it is reasonably practical.

‘Flexible working’ is a phrase that describes any working pattern adapted to suit your PA’s needs. It includes things like part-time working and flexitime.

Rest and breastfeeding at work

Employers must provide an area where pregnant workers and breastfeeding mothers can rest. Where necessary, the rest area should include somewhere for them to lie down. New and expectant mothers are entitled to more frequent rest breaks so you should discuss this with them, agreeing on their timing and frequency.

There are no legal restrictions on breastfeeding at work or any time limits on how long this should take. Before your employee returns from maternity leave you should ask for written confirmation if they are breastfeeding and intend to do so on their return to the workplace. This will give you the opportunity to provide a healthy, safe and suitable rest environment for them to do this.

Toilets are not a suitable place for new mothers to express milk. You may choose to provide a separate private environment where your employee can safely both express and store milk, though you are not legally obliged to do so.

Health and safety

You have a legal duty to protect the health and safety of new and expectant mothers who work for you as well as female PAs who are of childbearing age; if you fail to adequately protect the health and safety of your pregnant PA this can automatically be considered sexual discrimination.

The risk assessment

Some substances, processes and working conditions may affect a woman’s fertility as well as posing a specific risk to your pregnant PA and/or her unborn child. Therefore, you must think about the health of any PAs of childbearing age, not just those who have told you that they are pregnant.

However, once your PA tells you she is pregnant, you must review your risk assessment and identify any changes that are necessary to protect her health and that of her unborn baby. It is a good idea to involve the PA in the process and review the assessment as her pregnancy progresses to see if any further adjustments are needed.

If you wish you can use employer template 4.2(b) Risk assessment for new and expectant mothers for this purpose.

Things that might be hazardous to female PAs – and pregnant PAs in particular – include:

| manual handling and heavy lifting | night-time working |

| standing/sitting for long periods of time | stress |

| exposure to infectious diseases | radiation |

| excessive temperatures | long hours |

| exposure to toxic substances e.g. lead | excessive noise |

| violence | cigarette smoke |

Employer template 4.2(b) Risk assessment for new and expectant mothers provides specific guidance on hazards and risks which are specific to pregnant women as well as guidance on how to avoid them.

In addition if your PA has a specific pregnancy related condition e.g. high blood pressure or history of miscarriage you must take this into account in the risk assessment and adjust her working conditions appropriately.

If you identify a hazard which poses a risk to your pregnant PA, you must take steps to remove it, e.g. by adjusting her working conditions or working hours. If this isn’t possible, you must suspend the PA on normal pay for as long as the risk to her and/or her unborn child remains.

Your pregnant PA may also need extra rest breaks and you should be reasonable about this. In addition, you are required by law to provide somewhere for your pregnant PA to rest if she needs to.

When the PA returns to work after their maternity leave, their main risk assessment 4.2(a) Risk Assessment for PAs would need to be reviewed to account for any changes needed as a result of the PAs pregnancy.

Whilst your PA is on maternity leave

Making contact with your PA

During your PA’s SML you can make reasonable contact with each other. You can contact your PA by any means you both find appropriate e.g. telephone, email, letter, a meeting in the workplace.

The frequency and nature of any contact with them will depend on things like:

- the nature of the work;

- any agreement that you might have reached with the PA before their leave began; and

- whether either party needs to communicate important information to the other, e.g. changes in the workplace that might affect the PA on her return.

It is a good idea to discuss how you will keep in touch with your PA and how often you make contact before she begins her SML.

You must keep your PA informed of important information relating to her job that she would normally be made aware of if she was at work, e.g. workplace changes, training opportunities or redundancy situations.

Keeping-in-touch (KIT) days

Your PA may, in agreement with you, do up to ten days’ work during her SML period without it affecting her right to statutory maternity leave or pay. These are called ‘Keeping in Touch’ (KIT) days.

During KIT days, your PA can carry out work for you. This could be her normal day-to-day work or could, for example, be undertaking training or attending a team meeting. Any amount of work done on a KIT day counts as one KIT day. E.g. if your PA comes in for a one hour training session but does no other work that day, she will have used up one whole KIT day.

Please note: your PA cannot take a KIT day during compulsory maternity leave i.e. during the first two weeks after her baby is born.

Payment for KIT days

You should pay your PA her normal hourly rate for KIT days. If you wish you can alter this, with her agreement, on a discretionary basis e.g. you may wish to pay an enhanced rate. You must however make sure you pay her at least the minimum wage.

Your PA can work for you for up to ten KIT days during her maternity pay period without losing any SMP. If your PA is receiving statutory maternity pay (SMP) when she works a KIT day, you must continue to pay her SMP for that week.

If the PA has used her ten KIT days and she does any further work, she will lose a week’s SMP for the week in which she has done that work. If a week in her maternity pay period contains only KIT days, she would be paid SMP for that week. If a week in her maternity pay period contains the last KIT day and she does a further day’s work in the same week, she will lose SMP for that week.

Protection against detriment or dismissal in relation to KIT days

Your PA can only work a KIT day if she wants to and you agree to it. It is unlawful for you to treat your PA unfairly or dismiss her because she:

- refused to work a KIT day; or

- worked – or considered working – a KIT day.

If your PA believes that you have treated her unfairly or dismissed her under these circumstances, she may:

- resign and claim constructive dismissal;

- raise a grievance with you, which may result in a tribunal; or

- claim for detrimental treatment, unfair dismissal and/or sex discrimination if you fail to address it.