Introduction

When in receipt of a Direct Payment all funding is required to be paid into a separate bank account.

Prepaid cards

Most council funding for direct payments is paid for through a prepaid card account. This type of account is set up by the council and access to the account is given via a card.

The card can be issued to the person receiving a DP, a suitable person managing the direct payment for them, or it can be managed by Independent Lives who offer a manged bank account service.

The card holder can access the account 24/7, via telephone or online banking. Contact your funder for their contact details.

You can use your card to pay for any support that has been agreed in your support/personal plan. This includes payments to a care agency or your PA.

The council can see your spending as they have access to the account.

This will be a free service unless a managed bank account service is being used.

Opening a bank or building society account

If you are going to be receiving your Direct Payment into a bank or building society then this account must be separate from any personal accounts that you have.

We recommend that you use a completely different bank for your DP money as some banks have a policy of clearing personal money problems or overdrafts from any other accounts that you may have with them. If you keep your DP money at a different bank it saves this type of confusion.

You only need a basic current account. Some banks will promote ‘enhanced’ current accounts which incur a monthly charge. Banks can describe these as ‘reward accounts’, ‘added value accounts’, ‘premier accounts or accounts with ‘additions’ such as discounted services or insurance unrelated to Direct Payments. The council or NHS expects DP funds to be used only to pay for costs which are necessary to achieve the outcomes in your support/personal plan. Enhanced bank accounts which charge are not necessary to meet these outcomes and you should not use your Direct Payment to pay these charges.

Electronic payments (using your debit card), bank transfers or cheque payments should be made from this account to ensure all payments can be clearly evidenced. You should only make payments by cash in exceptional circumstances (with Social services/NHS agreement) and you must never pay your PAs in cash. You may want to ask your bank for a signature stamp, if you have difficulty signing cheques. Ink pads are available from stationary shops. If you need a close family member or partner to sign cheques for you, ask the bank about that person being a joint signatory on your DP bank account.

Sending in bank statements

If you do not have a prepaid card account and have opened a bank account for

your direct payment, you should keep copies of your bank statements as well as

providing copies to your funder

You must send a copy of your bank statements to the finance team of your funder e.g. Council or the NHS. If you have made any internet transfers/card payments, you should write on the bank statement what these are for as the statement will only list the organisation you made the payment to. You may be asked to send receipts or other evidence of what you have purchased along with your statement. You should also keep a copy of your bank statement for your own records.

If you have an online account, you can also send downloaded copies of your bank statements to the council or NHS via email. Please ask Independent Lives for further details.

Client contribution

If you have to pay a contribution toward your care, you will need to pay this into your prepaid card account or your bank/building society account by standing order. This payment needs to start from when the Direct Payment starts even if the DP is backdated.

Why do I need to keep financial records?

Your DP will be paid into the account monthly or four weekly and once you start employing PAs you will be making regular payments from the account eg PA wages. It is very important that you keep accurate financial records of all these payments.

Financial records are records of money coming into and money leaving your DP account. You must keep them so that you are able to:

- show how much money you have received into your DP bank account and what you have spent it on.

- check whether there are any mistakes on your bank statements

- track the progress of cheques you have written

- identify long term trends that lead to your account balance building up or getting low

- easily answer any questions that your funder may ask about your expenditure

- demonstrate that the DP money is not your personal income if HMRC or the Department for Work and Pensions enquire

Keeping a spending record

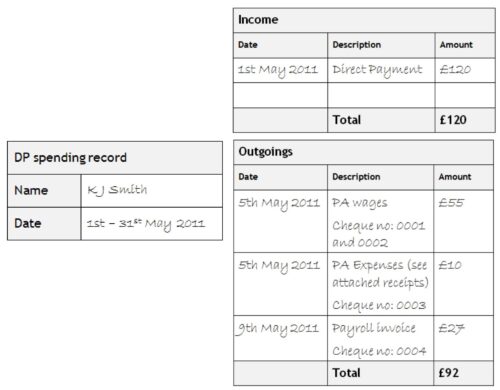

A spending record allows you to record all the money coming into and going out of your DP account- ‘income’ and ‘expenditure’. Your DP bank or pre-paid card statement will provide details of incoming and outgoing payments. It is also important to keep receipts and invoices so that you have evidence of exactly what each payment was for. Your spending record might look something like this:

Along with your spending record, remember to keep:

- Cheque stubs

- Invoices

- Receipts

- Bank statements

- Timesheets

- Sickness and holiday records

To help you keep your spending record you may find it helpful to use employer template 1.1 Spending record

It is vital that you keep receipts for all payments that you make by cash or debit card and that you make a note of what the item purchased was. You should only make payments by cash in exceptional circumstances (with Social services/NHS agreement) and you must never pay your PA’s in cash.

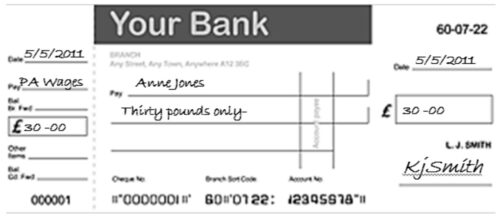

Cheques

If you write cheques from your DP account, it is important to make a note on the cheque stub of what the payment was for so that you can match it up to your bank statement:

Timesheets

It is also very important that you keep accurate records of the hours your PA’s have worked. You should ask your PA to complete a weekly timesheet. This will give you a record of the hours your PA has worked so that you and your payroll service know how much they should be paid. You should ensure that the timesheet is signed by you and the PA to ensure it is accurate.

If you wish you can use employer template 3.4 PA timesheet

You must also keep accurate records of any PA mileage or expenses (if agreed in your budget), holiday taken by your PA and any periods that they are off sick. You can find employer templates for these using the links below: